Importing goods from China has become an essential part of business for many UK companies, given China’s significant role as a global manufacturing hub. Understanding the complexities of import duties, taxes, and associated costs is crucial for businesses to manage expenses and ensure compliance with UK regulations.

Import Duties and Taxes

When goods are imported from China to the UK, several types of charges may apply, including import duty, Value Added Tax (VAT), and potentially excise duty. These costs are calculated based on the type and value of the goods.

- Import Duty: This depends on the commodity code (HS code) of the goods. For example, if you’re importing “Slippers and other indoor footwear,” the duty rate is 4.00% (code 6405209100). This rate is applied to the total value of the goods, including the cost of shipping and insurance. If a shipment of slippers costs £10,000 and shipping and insurance are £2,000, the total value is £12,000. Therefore, the import duty would be £480 (4.0% of £12,000).

- VAT: VAT is charged at 20% on the total value of the goods, including import duty. In the slippers example, VAT would be applied to £12,480 (goods + import duty), resulting in a VAT charge of £2,496.

- Excise Duty: This applies to specific goods like alcohol and tobacco. The rate varies depending on the product category.

- Anti-Dumping Duty: To protect local industries from unfair competition, the UK may impose an anti-dumping duty on certain goods that are priced significantly lower than the market value. This additional tariff aims to level the playing field for UK businesses.

Registration and Documentation

Businesses importing goods from China need to ensure they are properly registered:

- VAT Registration: Companies must be registered for VAT to handle transactions involving import duties and VAT.

- Economic Operator Registration and Identification (EORI) Number: This number is required for customs declarations and can be obtained from HMRC.

- Import Licenses: For restricted goods, such as firearms, an import license is necessary.

Shipping Costs

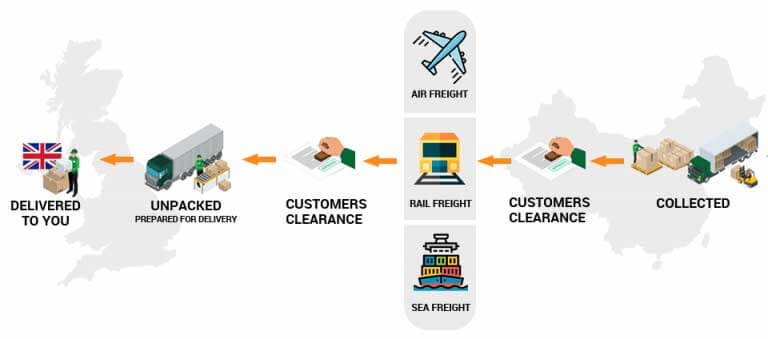

Shipping costs are a significant part of the total import expenses. These costs vary based on the shipping method (air, sea, or land), the weight and volume of the goods, and the shipping distance. It’s crucial to include these costs in the total value calculation for import duty and VAT purposes.

Using Currency Brokers

To manage the costs associated with currency exchange when paying Chinese suppliers, UK businesses can benefit from using currency brokers. Services like these offer competitive exchange rates, often better than traditional banks or payment services like PayPal. By converting money at exchange rates closer to the mid-market rate, businesses can save on transaction fees and get more value for their money.

For instance, paying a $10,000 US Dollar invoice through a currency broker may result in saving up to £300 or sometimes more compared to using a bank.

When sending payments to China you will be invoiced usually either in USD or CNY, for payments in CNY you will require a CNAPS code from the supplier.

Paying Import Duties and Taxes

Once goods arrive in the UK, customs will notify the carrier (such as Royal Mail or a courier service) of any import duties and taxes due. The carrier will then contact the recipient with the payment details. Typically, businesses have three weeks to settle these charges before the goods are returned to the sender. Pre-paying these charges by getting an invoice from the supplier can expedite the process.

Conclusion

Importing goods from China involves understanding and managing various costs, including import duties, VAT, and shipping expenses. By using services like Wise Business for currency conversion and ensuring proper registration with HMRC, UK businesses can streamline their import processes and reduce costs. Staying informed about applicable tariffs and maintaining compliance with import regulations are key to successfully importing goods from China.