Marketing materials form a crucial part of any business’s promotional strategy, yet many organisations overlook the significant tax relief opportunities available when investing in these essential tools. Understanding how to maximise these benefits can transform your marketing budget efficiency whilst ensuring HMRC compliance. As businesses face increasing pressure to optimise their spending, knowing how to properly claim tax relief on marketing investments becomes ever more valuable.

Key Considerations for Tax Relief

When investing in marketing materials for your business events, several factors can impact your tax relief eligibility. Understanding these elements thoroughly can help you make informed decisions about your marketing investments and ensure maximum tax efficiency.

Capital vs. Revenue Expenditure

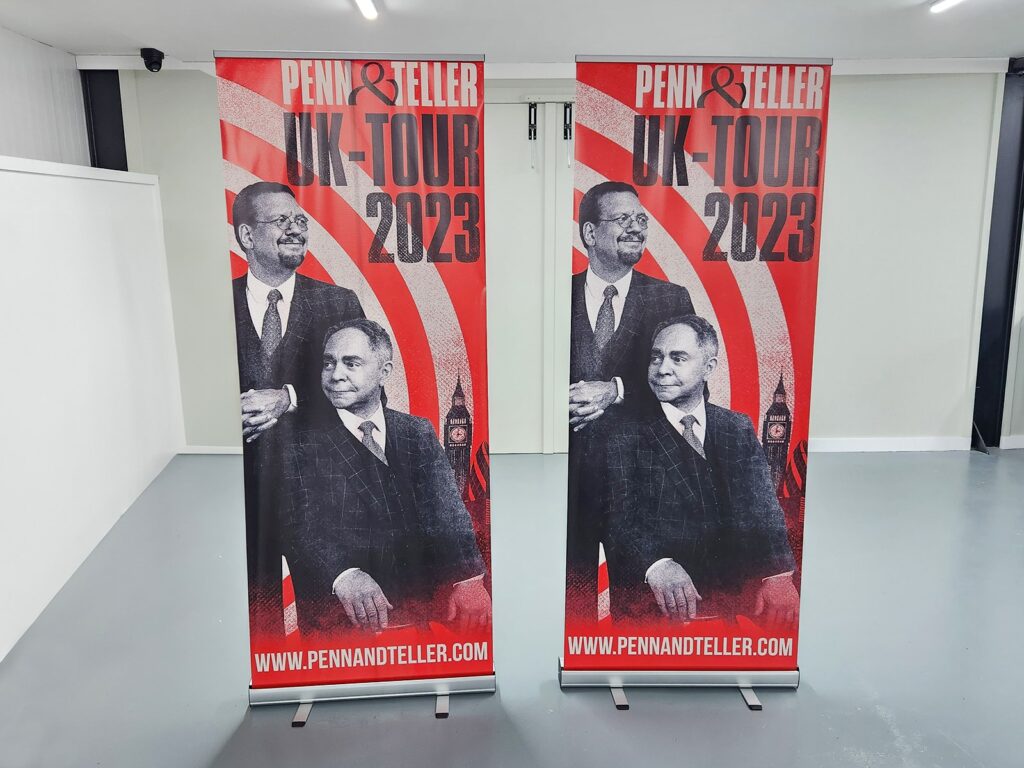

Marketing materials like roller banners and display stands often qualify as revenue expenditure rather than capital expenditure, making them potentially eligible for tax relief in the year of purchase. This classification applies particularly to temporary or replaceable promotional items used for specific campaigns or events. Understanding this distinction is crucial, as it affects both the timing and extent of tax relief available.

For example, a one-off banner for a trade show would typically qualify as revenue expenditure, whilst permanent branded fixtures might be considered capital expenditure. This classification can significantly impact your tax planning strategy and the timing of your marketing investments.

VAT Registration Benefits

For VAT-registered businesses, the ability to reclaim VAT on marketing materials can provide significant savings. Working with established suppliers like Banner World ensures you receive proper VAT documentation for your purchases, making the reclaim process smoother and more efficient.

When selecting marketing material suppliers, consider those who provide detailed invoices with clear VAT breakdowns and maintain comprehensive documentation. This attention to detail can prove invaluable during VAT reclaim processes and potential HMRC audits.

Timing Your Purchases

Strategic timing of marketing material purchases can optimise your tax position. Consider making significant investments in items like a roller banner before your financial year-end to maximise current-year tax relief opportunities. This approach requires careful planning and consideration of your business’s overall tax position.

Many businesses find it beneficial to create a marketing materials procurement calendar that aligns with their tax year, ensuring purchases are made at optimal times for tax relief purposes whilst still meeting their promotional needs.

Maximising Your Tax Benefits

Comprehensive Record Keeping

Maintain detailed records of all marketing material purchases, including:

- Purchase invoices with clear VAT breakdowns and supplier details

- Usage logs showing business purpose and event participation

- Documentation of event participation, including dates, locations, and business objectives

- Evidence of business promotion activities and outcomes

- Photographs or digital records of materials in use at events

- Maintenance and storage records for reusable items

Qualifying Expenses

Understanding which marketing materials qualify for tax relief is crucial. Generally, items that meet these criteria are eligible:

- Directly related to business promotion and revenue generation

- Professional in nature and presentation, maintaining brand standards

- Used exclusively for business purposes with clear promotional intent

- Supporting business revenue generation with measurable outcomes

- Temporary or consumable items used in marketing campaigns

- Materials that require regular replacement or updating

Digital Integration for Enhanced Tax Management

Modern marketing materials can serve dual purposes, both for physical presence and digital tracking. This integration not only enhances your marketing effectiveness but also strengthens your tax relief documentation. Consider these advanced approaches:

Digital Tracking Implementation

- Incorporate QR codes linking to landing pages (a free QR code generator makes this quick and easy)

- Use unique URLs for campaign tracking

- Implement NFC tags for interactive experiences

- Create digital attendance tracking systems

- Develop integrated campaign measurement tools

Documentation Benefits

- Generate automatic usage reports

- Track engagement metrics for tax purposes

- Create comprehensive digital audit trails

- Monitor campaign effectiveness data

- Document multi-channel marketing impact

Planning for Future Tax Benefits

Long-term Strategy Development

Develop a comprehensive marketing material strategy that considers both immediate tax benefits and long-term value. This approach should encompass:

Investment Planning

- Assess quality versus cost considerations

- Calculate potential tax relief benefits

- Plan replacement and update cycles

- Consider environmental impact and certifications

Design Considerations

- Create versatile designs for multiple events

- Plan for seasonal variations

- Include updating capabilities for key information

- Ensure brand consistency across materials

Professional Guidance

Whilst understanding tax relief basics is valuable, consulting with tax professionals about your specific situation ensures optimal outcomes. Professional advisors can:

- Review your marketing material investment strategy

- Identify additional relief opportunities

- Ensure compliance with current regulations

- Optimise timing of purchases and claims

- Advise on record-keeping requirements

- Support during HMRC inquiries

Looking Ahead

As tax regulations evolve and marketing practices advance, staying informed about relief opportunities becomes increasingly important. Regular reviews of your marketing material investments and their tax implications can help maximise benefits whilst maintaining effective promotional strategies.

Consider establishing a quarterly review process to:

- Evaluate the effectiveness of current materials

- Assess upcoming marketing needs

- Review tax relief claims and documentation

- Plan future investments and updates

- Monitor regulatory changes and updates

Final Thoughts

Marketing materials represent a significant investment for many businesses, but understanding and utilising available tax relief options can make these investments more cost-effective. By working with reputable suppliers and maintaining proper documentation, you can ensure both marketing success and tax efficiency.

Through careful planning, professional guidance, and strategic implementation, businesses can create a robust marketing materials strategy that maximises tax benefits whilst delivering strong promotional results. Remember to consult with qualified tax professionals regarding your specific situation, as tax regulations can vary and change over time.

Maximising Tax Relief: Smart Strategies for Event Marketing Materials

Marketing materials form a crucial part of any business’s promotional strategy, yet many organisations overlook the significant tax relief opportunities available when investing in these essential tools. Understanding how to maximise these benefits can transform your marketing budget efficiency whilst ensuring HMRC compliance. As businesses face increasing pressure to optimise their spending, knowing how to properly claim tax relief on marketing investments becomes ever more valuable.

Key Takeaways

- Strategic timing of marketing material purchases and proper VAT documentation can lead to substantial tax savings for your business

- Digital integration through QR codes and tracking systems strengthens tax relief claims whilst enhancing campaign effectiveness

- Working with established suppliers like Banner World ensures proper documentation and smoother VAT reclaim processes

- Professional tax guidance combined with detailed record-keeping maximises available relief opportunities whilst maintaining compliance

Common Marketing Materials and Their Tax Treatment

| Marketing Material | Tax Classification | Relief Timing | Documentation Required |

| Roller Banners | Revenue Expenditure | Immediate | Invoice, Usage Log, Event Photos |

| Exhibition Stands | Capital Expenditure | Over Multiple Years | Purchase Order, Asset Register, Depreciation Schedule |

| Promotional Flags | Revenue Expenditure | Immediate | Invoice, Campaign Details |

| Digital Displays | Capital Expenditure | Over Multiple Years | Full Purchase Documentation, Installation Records |

Key Considerations for Tax Relief

When investing in marketing materials for your business events, several factors can impact your tax relief eligibility. Understanding these elements thoroughly can help you make informed decisions about your marketing investments and ensure maximum tax efficiency.

Capital vs. Revenue Expenditure

Marketing materials like roller banners and display stands often qualify as revenue expenditure rather than capital expenditure, making them potentially eligible for tax relief in the year of purchase. This classification applies particularly to temporary or replaceable promotional items used for specific campaigns or events. Understanding this distinction is crucial, as it affects both the timing and extent of tax relief available.

For example, a one-off banner for a trade show would typically qualify as revenue expenditure, whilst permanent branded fixtures might be considered capital expenditure. This classification can significantly impact your tax planning strategy and the timing of your marketing investments.

Timing Your Tax Relief: Quarterly Planning Guide

| Quarter | Action Items | Tax Considerations | Documentation Deadline |

| Q1 (Apr-Jun) | Review annual marketing plan | Plan major purchases | End of June |

| Q2 (Jul-Sep) | Assess mid-year requirements | Consider interim claims | End of September |

| Q3 (Oct-Dec) | Begin year-end planning | Project final quarter spend | End of December |

| Q4 (Jan-Mar) | Finalise year-end purchases | Maximise current year relief | End of March |

VAT Registration Benefits

For VAT-registered businesses, the ability to reclaim VAT on marketing materials can provide significant savings. Working with established suppliers like Banner World ensures you receive proper VAT documentation for your purchases, making the reclaim process smoother and more efficient.

When selecting marketing material suppliers, consider those who provide detailed invoices with clear VAT breakdowns and maintain comprehensive documentation. This attention to detail can prove invaluable during VAT reclaim processes and potential HMRC audits.

Timing Your Purchases

Strategic timing of marketing material purchases can optimise your tax position. Consider making significant investments in items like a roller banner before your financial year-end to maximise current-year tax relief opportunities. This approach requires careful planning and consideration of your business’s overall tax position.

Digital Integration Cost-Benefit Analysis

| Integration Type | Initial Cost | Tax Relief Potential | ROI Tracking Capability |

| QR Codes | Low | Immediate | High |

| NFC Tags | Medium | Over 1 Year | Very High |

| Custom URLs | Low | Immediate | Medium |

| AR Features | High | Over 2-3 Years | Very High |

Maximising Your Tax Benefits

Comprehensive Record Keeping

Maintain detailed records of all marketing material purchases, including:

- Purchase invoices with clear VAT breakdowns and supplier details

- Usage logs showing business purpose and event participation

- Documentation of event participation, including dates, locations, and business objectives

- Evidence of business promotion activities and outcomes

- Photographs or digital records of materials in use at events

- Maintenance and storage records for reusable items

Record-Keeping Requirements

| Document Type | Retention Period | Format Required | Critical Elements |

| Purchase Invoices | 6 Years | Digital/Physical | VAT Details, Supplier Info |

| Usage Logs | 3 Years | Digital | Dates, Events, Purpose |

| Asset Register | Life of Asset + 6 Years | Digital | Purchase Date, Value |

| Maintenance Records | Asset Life | Either | Service Dates, Costs |

Qualifying Expenses

Understanding which marketing materials qualify for tax relief is crucial. Generally, items that meet these criteria are eligible:

- Directly related to business promotion and revenue generation

- Professional in nature and presentation, maintaining brand standards

- Used exclusively for business purposes with clear promotional intent

- Supporting business revenue generation with measurable outcomes

- Temporary or consumable items used in marketing campaigns

- Materials that require regular replacement or updating

Qualifying Expenses Checklist

| Expense Type | Relief Available | Key Requirements | Common Pitfalls |

| Event Banners | Full | Business Use Only | Personal Use Mixing |

| Trade Show Materials | Full | Event Documentation | Missing Evidence |

| Promotional Displays | Partial | Asset Classification | Incorrect Timing |

| Digital Elements | Variable | Technology Classification | Over-Claiming |

Digital Integration for Enhanced Tax Management

Modern marketing materials can serve dual purposes, both for physical presence and digital tracking. This integration not only enhances your marketing effectiveness but also strengthens your tax relief documentation. Consider these advanced approaches:

Digital Tracking Implementation

- Incorporate QR codes linking to landing pages

- Use unique URLs for campaign tracking

- Implement NFC tags for interactive experiences

- Create digital attendance tracking systems

- Develop integrated campaign measurement tools

Documentation Benefits

- Generate automatic usage reports

- Track engagement metrics for tax purposes

- Create comprehensive digital audit trails

- Monitor campaign effectiveness data

- Document multi-channel marketing impact

Cost-Saving Comparison

| Marketing Material | Traditional Cost | With Tax Relief | Net Saving |

| Standard Banner | £300 | £240 | £60 |

| Exhibition Display | £1,000 | £800 | £200 |

| Digital Integration | £500 | £400 | £100 |

| Full Event Kit | £2,500 | £2,000 | £500 |

Planning for Future Tax Benefits

Long-term Strategy Development

Develop a comprehensive marketing material strategy that considers both immediate tax benefits and long-term value. This approach should encompass:

Investment Planning

- Assess quality versus cost considerations

- Calculate potential tax relief benefits

- Plan replacement and update cycles

- Consider environmental impact and certifications

Design Considerations

- Create versatile designs for multiple events

- Plan for seasonal variations

- Include updating capabilities for key information

- Ensure brand consistency across materials

Professional Guidance

Whilst understanding tax relief basics is valuable, consulting with tax professionals about your specific situation ensures optimal outcomes. Professional advisors can:

- Review your marketing material investment strategy

- Identify additional relief opportunities

- Ensure compliance with current regulations

- Optimise timing of purchases and claims

- Advise on record-keeping requirements

- Support during HMRC inquiries

Looking Ahead

As tax regulations evolve and marketing practices advance, staying informed about relief opportunities becomes increasingly important. Regular reviews of your marketing material investments and their tax implications can help maximise benefits whilst maintaining effective promotional strategies.

Consider establishing a quarterly review process to:

- Evaluate the effectiveness of current materials

- Assess upcoming marketing needs

- Review tax relief claims and documentation

- Plan future investments and updates

- Monitor regulatory changes and updates

Final Thoughts

Marketing materials represent a significant investment for many businesses, but understanding and utilising available tax relief options can make these investments more cost-effective. By working with reputable suppliers and maintaining proper documentation, you can ensure both marketing success and tax efficiency.

Through careful planning, professional guidance, and strategic implementation, businesses can create a robust marketing materials strategy that maximises tax benefits whilst delivering strong promotional results. Remember to consult with qualified tax professionals regarding your specific situation, as tax regulations can vary and change over time.