Understanding the VAT number meaning is essential for businesses operating in countries with a Value Added Tax (VAT) system. This tax is a consumption-based levy charged at every stage of the supply chain, and a VAT number is a crucial identifier for compliance with VAT regulations. Whether you are running a local business or engaging in international trade, knowing the VAT number meaning can help you navigate taxation rules, avoid penalties, and streamline operations.

What Does VAT Number Mean?

A VAT number is a unique identification number assigned to businesses registered for Value Added Tax. This number is used to track and document VAT-related transactions. It ensures that businesses collect VAT from their customers, report it to the tax authorities, and reclaim any VAT paid on purchases. The VAT number meaning varies slightly between countries, but its core function remains the same: identifying businesses for VAT purposes.

In countries with a VAT system, the tax is applied to the sale of goods and services. Businesses need a VAT number if they exceed the taxable turnover threshold or engage in specific taxable activities, such as importing goods or selling across borders.

Why Is a VAT Number Important?

The VAT number meaning becomes evident when you consider its importance in business operations. A VAT number is mandatory for businesses that:

- Sell goods or services subject to VAT.

- Engage in cross-border trade within regions like the European Union (EU).

- Import or export goods in VAT-implementing countries.

This number ensures that businesses:

- Comply with VAT laws by collecting and remitting taxes.

- Avoid penalties for failing to register for VAT.

- Claim refunds on VAT paid for business expenses.

Without a VAT number, businesses cannot legally operate in VAT-eligible transactions, and they may face fines or restrictions.

When Do Businesses Need a VAT Number?

The need for a VAT number depends on the nature of your business activities. The VAT number meaning becomes relevant when you:

- Exceed the taxable turnover threshold in your country.

- Make taxable sales within a country where VAT applies.

- Import goods or move goods across borders in the EU.

- Conduct intra-community trade, such as buying goods in one EU country and selling them in another.

For example, if you are a non-EU company selling digital services to EU customers, you must register for VAT under the EU VAT rules. Similarly, e-commerce businesses often need a VAT number to comply with tax obligations in multiple jurisdictions.

How to Obtain a VAT Number

Understanding the process of obtaining a VAT number further clarifies the VAT number meaning. Businesses must apply for a VAT number with the tax authorities in the country where they operate. The application typically involves submitting business details, proof of registration, and information about taxable activities.

The steps include:

- Registering your business with the local tax authority.

- Completing the VAT registration form with accurate information.

- Providing documentation, such as incorporation certificates, Articles of Association, and proof of taxable transactions.

- Waiting for the application to be processed, which may take a few weeks depending on the country.

Once approved, the tax authorities issue a unique VAT number that must be used on invoices and reports.

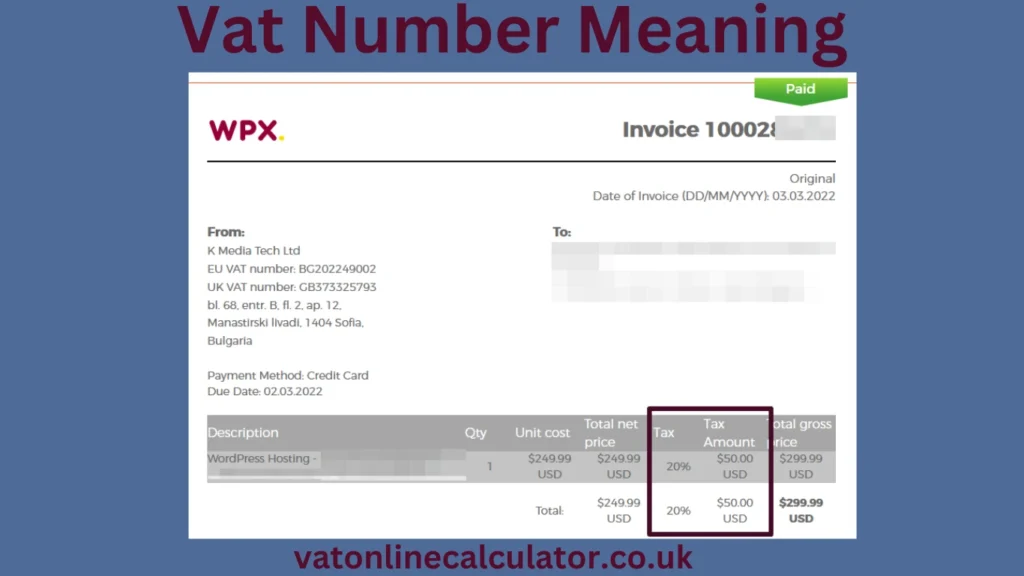

Examples of VAT Number Usage

The VAT number meaning is best illustrated with real-world examples. Suppose a company based in Germany buys goods from a local supplier and sells them to a German customer. The business must include its German VAT number on invoices to charge VAT. Similarly, if the company exports goods to France, it needs a VAT number for cross-border transactions and must adhere to EU VAT rules.

In another scenario, a UK-based business providing digital services to EU customers must register for VAT in the EU. The VAT number allows the business to charge VAT where required and comply with the EU’s digital taxation rules.

Table: Example VAT Number Formats

| Country | Country Code | Example VAT Number |

| United Kingdom | GB | GB123456789 |

| Germany | DE | DE12345678901 |

| France | FR | FR12345678901 |

| Italy | IT | IT12345678901 |

| Spain | ES | ESX12345678 |

This table illustrates how VAT number formats vary by country. The country code is a prefix followed by unique digits or letters.

Also, Read What is an Urban Clearway? A Complete Guide for City Drivers

Responsibilities of VAT-Registered Businesses

The VAT number meaning also includes the responsibilities that come with registration. Businesses with a VAT number must:

- Charge VAT on taxable sales and include the VAT amount on invoices.

- File VAT returns periodically, reporting collected and reclaimable VAT.

- Maintain accurate records of all VAT transactions.

- Comply with local VAT regulations, including issuing invoices with the VAT number.

Failure to meet these obligations can lead to penalties and suspension of VAT registration.

How to Check the Validity of a VAT Number

The validity of a VAT number can be verified through online systems like the EU’s VAT Information Exchange System (VIES). This system allows businesses to check if a VAT number is active and valid in the EU. Knowing how to validate a VAT number ensures that your transactions comply with tax laws and prevents potential disputes with tax authorities.

For businesses operating in the UK, separate systems are available to validate VAT numbers, as the UK is no longer part of the EU VAT system post-Brexit.

Frequently Asked Questions

What is the VAT number meaning?

The VAT number meaning refers to a unique identifier for businesses registered for Value Added Tax. It helps tax authorities track VAT transactions.

Who needs a VAT number?

Businesses selling taxable goods or services, engaging in cross-border trade, or importing/exporting goods typically need a VAT number.

How do I get a VAT number?

You can apply for a VAT number through your local tax authority. The process involves submitting an application and relevant documents.

How long does it take to get a VAT number?

The process usually takes 4–6 weeks, but this may vary depending on the country and the completeness of your application.

Can I operate without a VAT number?

If your activities require VAT registration and you fail to obtain a VAT number, you may face penalties or legal restrictions.

Conclusion

The VAT number meaning extends beyond being a simple identifier; it is a crucial tool for businesses operating in VAT-implementing countries. From facilitating legal compliance to enabling seamless cross-border trade, a VAT number is indispensable for modern businesses. Understanding its importance, how to obtain one, and how to use it effectively ensures smooth operations and adherence to tax regulations. Whether you are a local entrepreneur or an international trader, grasping the VAT number meaning can help you stay compliant and avoid unnecessary complications.

Also, Read What Does Manifested for Delivery Mean? A Simple Guide