Last updated: December 06, 2022

Use our online VAT calculator to calculate VAT Inclusive and VAT Exclusive.

How to use the VAT calculator

With the new online VAT calculator, you can calculate VAT inclusive and VAT exclusive prices with ease. It only takes 3 easy steps to calculate VAT:

- Make sure you know the VAT rate. The default is 20%

- Calculate the gross or net amount

- To remove VAT from the amount, Select “Remove VAT” or to add VAT to the amount, Select “Add VAT“

With a VAT calculator online, you can figure out how much VAT (see about VAT below) you have to pay or claim, and the gross price of goods or services based on the net price. When you finish your purchase, the gross price is what you will pay at the register.

We created this FREE online VAT calculator that allows you to reverse, remove, include & add VAT. In addition to calculating inclusive VAT, this VAT calculator can also calculate exclusive VAT.

VAT percentages are pre-set for the UK. Your own percentage can be used. Enter your price and click calculate to calculate VAT.

VAT calculator set to UK rates

| 📑 Calculating VAT | YES |

| ⚙️ Customizable VAT rates | YES |

| ➕ Add VAT to a price | YES |

| ➖ Remove VAT from total | YES |

Click to check current VAT Rates in UK

VAT Inclusive and VAT Exclusive Formula

ADD VAT

Getting Gross price: Price(1+VAT/100) Inclusive VAT: PriceVAT/100

REMOVE VAT

Getting Net price: Price/(1+VAT/100) Exclusive VAT: Price/(1+VAT/100)*(VAT/100)

What is VAT

Value-added taxes, also known as goods and services taxes in some countries, are incremental taxes. Each stage of production, distribution, or sale of a product or service is subject to taxation.

What is the UK rate?

In the UK, 20% VAT is the standard rate. At 5% it’s reduced. The standard rate of 20% applies to most goods and services. This rate should be charged unless reduced or zero-rated goods or services are involved.

Products & Services VAT Rates in the UK

Food VAT Rates in the UK

Most food within the UK is zero-rated, which means you do not have to pay VAT on it. This information comes from (official site) The following foods and drinks are zero-rated:

Food products that are VAT exempt in the UK

| Biscuits | Cereals Fish and live Fish | poultry, Eggs & meat |

|---|---|---|

| Jaffa Cakes and chocolate teacakes | Cooking oil | Nuts & pulses |

| Pita bread, baps, rolls, and baps | Ready meals that are chilled or frozen (convenience foods) | Water |

| Food in cans and freezers without ice cream | Salt | Milk, butter, cheese |

| Sandwiches | Tea, coffee & cocoa | vegetables & Fruit |

There are, however, some food items and drinks that are subject to standard VAT rates, including:

Food products that are not VAT-exempt in the UK

| Biscuits with chocolate only | Confectionery/sweets | Juices & cold drinks (not milk) |

| Alcoholic drinks | Chocolate | Ice cream |

| Cereal bars | Restaurants, cafes, hotels, etc.) Supplies of food and drinks for consumption on the premises (at restaurants, cafes, hotels, etc.) | Potato crisps |

| Drinks containing carbon dioxide and bottled water (including mineral water) | You can order hot food & drinks for takeout (such as burgers, hot dogs, toasted sandwiches, etc.) | Nuts |

Zero-rated items for UK VAT

The following products are all zero-rated for UK VAT.

Any of these purchases will not be subject to VAT, so ask your supplier or retailer if you’re being charged VAT.

| Aircraft (for sale/charter) | Helmets for bicycles and motorcycles | Chocolate-free biscuits |

| Fares for public transportation (buses, trains, and tubes) | Culinary salt | Cold sandwiches |

| Providing disability services | Jaffa Cakes (including chocolate teacakes) | Foods in cans and frozen (without ice cream) |

| (Raw for human consumption) Nuts & pulses | Medicines on prescription | Industrial protective boots & helmets |

| E-books, maps, and charts | Pita bread, bread rolls, baps, and baps | Pamphlets, brochures, and leaflets |

| Sewage systems for domestic and industrial use | Ten or more passengers must be transported by vehicle, boat, or aircraft | Foods that are chilled or frozen and are ready to eat |

| Construction of ships (15 tonnes or more) | Tea, coffee & cocoa | Water (household) |

| Cereals | Building and selling new homes | Cooking oil |

| Journals, magazines, and newspapers | Human consumption of live animals | Vegetables and fruits |

| Poultry & meat | Cheese, milk, and butter | Disabled people’s equipment (including blind and partially sighted equipment) |

| The sale of donated goods at charity shops | Live fish (included) | Eggs |

UK VAT Exempt Items & Services

| If sold to a public institution, antiques, works of art, or other similar items | Insurance for funeral plans | Subscriptions to membership |

| A museum, an exhibition of art, a zoo, or a performance that is operated by a government agency is considered a cultural event. | The provision of financial support (such as money transactions, loans, credits, savings, deposits, shares, and bonds) | Treatment & care for medical conditions |

| Cremation or burial (human) | The gambling industry (betting, gaming, bingo, lottery) | Postage stamps |

| Selling, leasing, and letting commercial land and buildings | Insurance | TV license |

| Training and Education | Services related to health (doctor, dentist, optician, pharmacist, etc.) | Physical education and sports activities |

VAT-registered businesses are responsible for collecting VAT on behalf of HMRC. A VAT number is assigned to each registered company after registration. The same companies are also eligible for VAT reimbursement on relevant purchases.

As a condition of its entry into the European Economic Community, the United Kingdom introduced the value-added tax in 1973 to replace Purchase Tax and Selective Employment Tax. More information about VAT can be found on Wikipedia. Furthermore, you can check how much is vat below:

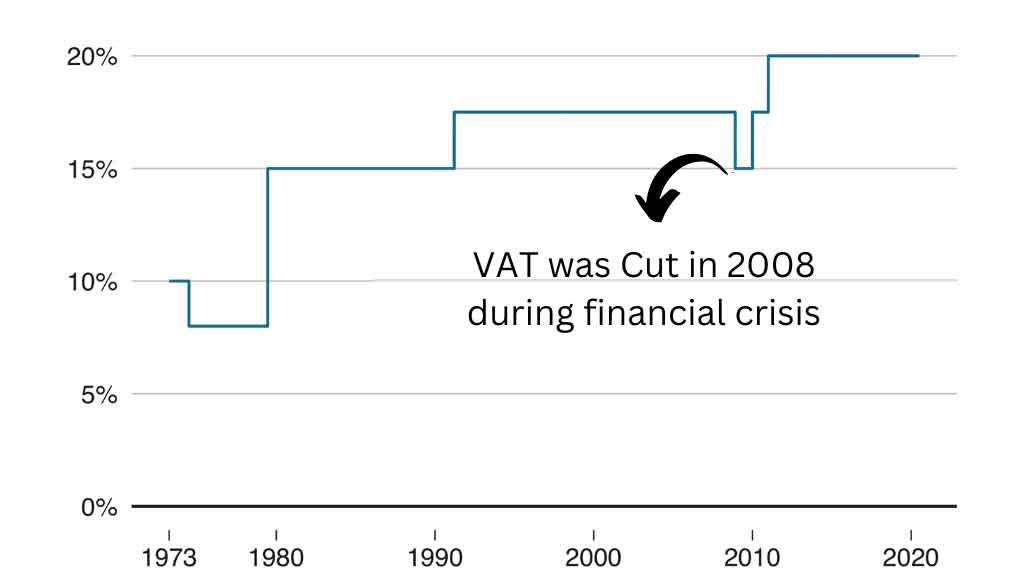

VAT rate over time for the UK

How is VAT calculated in UK?

Reduced-rate ESP (5% goods) = $105 after deducting the ESP. At a 20% VAT rate, sales of goods would be $22,395. Using the 20% goods as an example, divide by six to calculate the VAT due on them = £3,732.50. Use a ratio of 21 to determine the VAT due on the 5% goods, which is $5. This page includes a VAT reverse calculator.

VAT Historical Rates

The UK implemented a 10% value-added tax on April 1st, 1973.

The VAT rate has been reduced to 8%, but the fuel tax has been raised to 25% on July 29th, 1974

The rate of value-added tax has been raised to 15% on June 18th, 1979

VAT has been raised to 17.5% on April 1st, 1991

Reduced sales tax rate by 15% on December 1st, 2008

The standard rate was raised to 17.5% and the reduced rate was introduced at 7% on January 1st, 2010

Standard VAT rates are raised to the current 20%, with the reduced rate being 5% on January 4th, 2011

VAT Calculation and Examples of VAT Inclusive and VAT Exclusive

You can calculate VAT online in either direction by following these simple steps.

The formula for including/adding VAT

Dividing the price by 100 and multiplying it by the VAT percentage is the correct method for adding VAT to the price. Including VAT (Gross) is the total amount. Be sure to use our vat inclusive calculator so you don’t make a mistake.

- The price/figure should be multiplied by 1 + VAT rate

- As an example, the UK VAT rate is 20%, so the price/figure would be multiplied by 1.25.

- The price of £100 multiplied by 1.2 equals £120, which is the price/figure after VAT is added.

Simplify:

Amount – £1000

VAT Rate – 20%

Gross Amount = (1000/100)*120 = 1200

Example of VAT addition

If you sell home gear for £1000, for instance

- To begin, you must divide 100 percent by the amount

- Add 120 percent to this value

- The total price includes VAT, which comes to £1200

The formula for Reversing/Removing VAT

Dividing the amount by (100 + VAT percentage) and multiplying it by 100 will remove VAT from the price. There is no VAT included in this price (Net). If you need further assistance, please use our vat exclusive calculator.

- The price/figure should be divided by 1. + VAT rate

- If you want to calculate UK VAT at 20%, you would calculate price/figure / 1.25

- As an example, if £120 is the figure / 1.2, then £100 is the price or figure excluding VAT

Simplify:

Amount – £1000

VAT Rate – 20%

Net Amount = (1000/120) * 100 = 833.33

Example of VAT Subtraction

For instance, if you purchased a sports item for £1000 Gross

- Dividing the price by 120 percent is the first step

- Add 100 percent to the value obtained

- The excluding VAT price is £833.33

VAT Facts

This page contains facts about VAT that you may not be aware of.

During the introduction of VAT, it was described as a “simple tax”, but its complexity has caused it to be compared to a “fiscal theme park where reality is suspended and distorted.” Sound exaggerated? These ten odd facts about VAT might be of interest to you…

- According to their decorations, gingerbread men can be classified differently. There is no VAT on two chocolate spots for eyes on a gingerbread man, but any other chocolate decoration is liable for VAT.

- Unlike stolen goods, stolen cash is not subject to VAT when stolen from a shop.

- However, counterfeit cash is exempt from VAT while sales of counterfeit goods are.

- Caviar, lap dances, and labrador food are not considered luxuries, but orange squash, petrol, ice cream, and poodle food are.

- Unlike honey bees, bumblebees are subject to VAT.

- When you add caramel to chocolate-covered shortbread, it becomes Millionaire’s shortbread, which is not subject to VAT.

- The VAT law refers to ferrets as pets; rabbits are not.

- When nuts are sold still in their shells, they are zero-rated, whereas that outside of their shells is subject to tax.

- Ebooks are not exempt from VAT, but physical publications are.

- I have to mention the famous Jaffa cake debate too, just recently resolved by a majority of Upper Tribunal judges who determined that a Jaffa cake was in fact a cake, meaning the price was taxed differently from what it would be if it were a biscuit.

Frequently Asked VAT Questions & Answers

The following is a collection of information on value-added tax in the form of questions and answers.

What is the current VAT rate in UK?

In the UK, the VAT rate is usually 20%, but Chancellor Rishi Sunak lowered it in his mini-budget in July last year during the Covid crisis. Businesses in the hospitality and tourism industries have been given a VAT rate reduction to 5 percent. Due to the pandemic, the industry was hit hard and took a beating. Read more

What is the Flat Rate VAT Scheme?

VAT flat rate schemes let businesses pay a fixed percentage of their revenue for VAT. Small business owners can simplify the VAT Return process by implementing the VAT Flat Rate Scheme. Read more

How to check a company VAT number?

You should check any invoice that another business has given you for its VAT number if you’re looking for it. Invoices for VAT-registered companies should list their unique VAT number. Read more

How to register for VAT?

Understanding VAT and what it means for your business, as well as ensuring you are aware of the £85,000 VAT threshold, is vital. VAT registration can be done online if it is on the horizon for your business. Read more